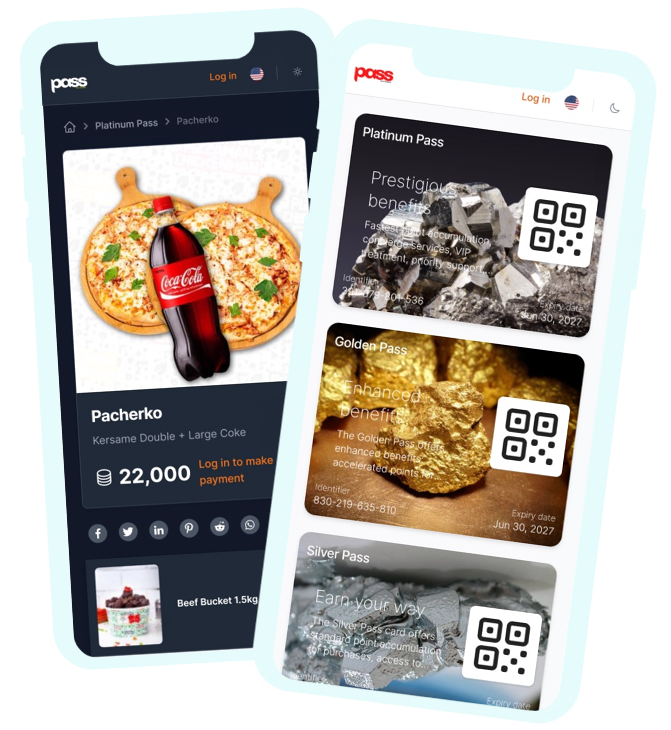

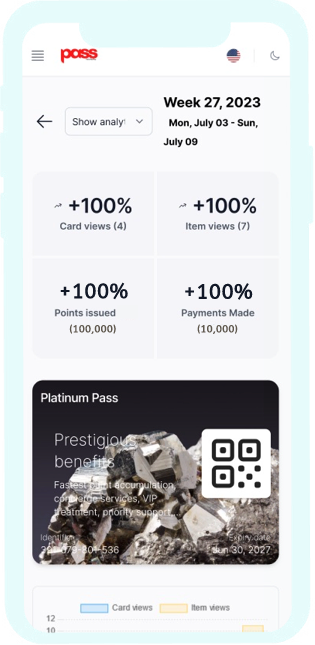

Empowering Financial Inclusion and Convenience

At Pass by RedPay, we believe in empowering individuals by providing them with access to financial services and essential products through our innovative loyalty and payment platform. Our mission is to bridge the gap and foster financial inclusion for the unbanked population in Africa beginning with Ghana.